Thank you for sharing your interest with us.

Please bookmark this page so that you can easily refer back to it.

Next Steps For Medicare-Start Here

We are going to send you a Consent to Contact Form and a Scope of Appointment form.

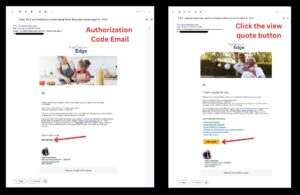

We will also send you a quote for a plan we’ve never discussed from a software platform called Plan Compare Edge. The purpose of this is not to sell you a plan, but to securely collect your doctors, pharmacy and prescriptions. You will get 2 emails, one will contain an authorization code and the next will be the basic quote to get started. Once you get into Plan Compare Edge, please enter your doctors, pharmacy and prescriptions.

Below is what these emails will look like:

They will come in at the same time.

Once we’ve received the completed forms back,we’ll send you a link to schedule an appointment. You should be aware that CMS requires at least 48 hours between receipt of a completed Scope of Appointment and a held appointment.

If you have an urgent situation or deadline, please let us know immediately so we can evaluate if an exception exists.

Some of our clients will review this material in it’s entirety. Please be aware the purpose of our meeting is not to review this information, we’re happy to answer questions if you’ve found any of it confusing. The purpose of the meeting is for us to validate your information, and your priorities so that we can make a plan that may include a plan recommendation.

CMS Disclaimer: We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Your quote, which will be based on your zip code and county you provided, will tell you specifically how many organizations and products we offer in your area. Please contact https://Medicare.gov or 1-800-MEDICARE to get information on all your options.

Next Steps For Affordable Care Act (ACA)-Start Here

In order for us to get the most out of our first meeting please read and take the following steps. I know many of our clients find this email long; all of this information has to be covered at some point, and this both makes sure we cover it, and that you can easily refer back to it at any time. Thanks for your understanding!

If you or a member of your household is or may soon be eligible for Medicare, we will send you an additional email regarding that member. If the eligibility is not due to age (65+) please let us know.

Please understand that when obtaining health insurance in compliance with the Patient Protection and Affordable Care Act (PPACA, ACA, Obamacare etc) there are five major factors in determining premiums and benefits:

- Household composition (the number of people on the same tax filing generally, but living together or financially dependent more generally)

- Age (generally under 18, each age 19-64, 65+ if not eligible for Medicare)

- Smoking Status (often you will need to have been tobacco-free for 12-24 months to remove this status)

- County (because this is how rates are filed)

- Household Income (Minnesota guidelines) (National Guidelines) Additional information on what is reportable income and deductions

Beyond this, plans generally come in the following forms:

- Medicaid (national name) or MedicalAssistance (in Minnesota) or BadgerCare (in Wisconsin)

- MinnesotaCare (only a few states including New York have equivalent options)

- Qualified Health Plans (QHP) (MNsure Plan Comparison Tool; Federal Window Shopping Tool)Catastrophic (for people under 30 or with a waiver)

- Bronze

- Silver

- Gold

- Platinum (not often available)

- Certain mandated standard plans

- QHP can further be divided into

- Traditional

- HSA compatible

Account Creation

If you don’t already have a MNsure account (or healthcare.gov if in most other states) and know that you are not on anyone else’s account, then you (or the younger spouse if married) should set up a MNsure account. While often easy, this can be a tricky step due to the identity verification process. This is why it is valuable to start early. We do NOT recommend submitting an application for health insurance with assistance before speaking to us. If you have already done so, we will work with you on determining if this is accurate and we should move forward or if we will need to take other steps. If you are on someone else’s account we should speak first, but you may need to be removed before creating your own account.

Let me know if you have significant health concerns (not what they are, but that you have them). Usually this means you have a chronic condition, expensive prescriptions, or are unwilling to change your doctor/clinic/hospital. If this is the case, we will send you an additional link where you can securely enter this information for each relevant member. Each member will get their own link.

Let us know if you have any other special considerations you want us to take into account. Some possibilities we often hear:

- You qualify for a Health Reimbursement Arrangement (HRA) from a current or former employer

- A planned move outside of your current county/state (please provide as much address information as possible with the priority being the state and county)

- A second home (if so please provide the full address including county)

- Consistent time spent out of the state of your primary residence

- International travel (GeoBlue)

- Household members who do not live together, especially if they are in different states or countries

- What your Qualified Event (QE) is that will trigger the Special Enrollment Period (SEP). Note, the QE must be reported by “applying” for a SEP.

Our conversation, when we speak will focus on the following:

- Have we (you and I) correctly identified the five major factors in determining premium and benefits (listed above)

- Do you have the ability, now or in the future, to control your income and therefore your eligibility for the various program types?

- Are you open to all program types?

- What is your preferred outcome? Often this is minimizing, Premiums, Out-of-Pocket Costs, or Total Costs (our preference)

- Maintaining access to key providers (we recommend a flexible mindset here)

With this information in mind, we will proceed to offer you our recommendation for your next steps.

Should you choose to enroll, we will remain available to review your plan in the future, help in many situations if you are confused about how the plan works or how to use it, or understand how changes to your financial or health impacts your current and future plan choices. We would love to continue helping in the future, even if there may be periods where you have other insurance we did not help you select until eventually we hope to help you with your Medicare choices. Please let us know if you would like to be removed from our contact list.

Additional considerations

I and our organization are made up of licensed insurance agents (sometimes called brokers because we offer more than one insurance company’s plans). As such, we operate in a highly regulated industry and many important disclosures follow. Please do not skip these unless you are already familiar with them as we will assume you are aware of this information going forward.

We are paid commissions by the insurance companies when and while you are enrolled in a plan. The amount varies from carrier to carrier. Specifics on our carriers and compensation can be found here. What we believe is most important to you, is that your premiums and benefits will not be more or less if you work with us, another agent, or you purchase the plan yourself. The insurance companies assume many members will want and will benefit from having this assistance and so just like they build their call center, their printing and mailing, their website, and all their other operational costs into their plan, the cost of our assistance is built into the plan regardless of how you enroll.

We work very hard to be “objective and comprehensive” while advising clients. Sometimes we must all recognize that there is no perfect solution, for you the client, or for us as professionals. We will always work to make sure you understand the various trade-offs, for yourself, and that we are dealing with that are relevant to your decision.

CMS Disclaimer: We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Your quote, which will be based on your zip code and county you provided, will tell you specifically how many organizations and products we offer in your area. Please contact https://Medicare.gov or 1-800-MEDICARE to get information on all your options.